Record Retention Requirements For Payroll . Web as a rule of thumb, employers are required to retain some payroll records for at least four years, but some experts. Web your company must retain its records for at least 5 years from the relevant ya. Web what employee records do i need to keep? Web the records must be retained for at least 5 years from the end of the financial year in which the relevant transactions. Companies with dec financial year end. If you’re an employer, you need to keep a register of employees. Web according to the internal revenue service (irs), an employer must retain payroll records relating to payroll taxes a minimum of four years. Web for the purposes of section 95(1) of the act, the record retention period for an employee record relating to an.

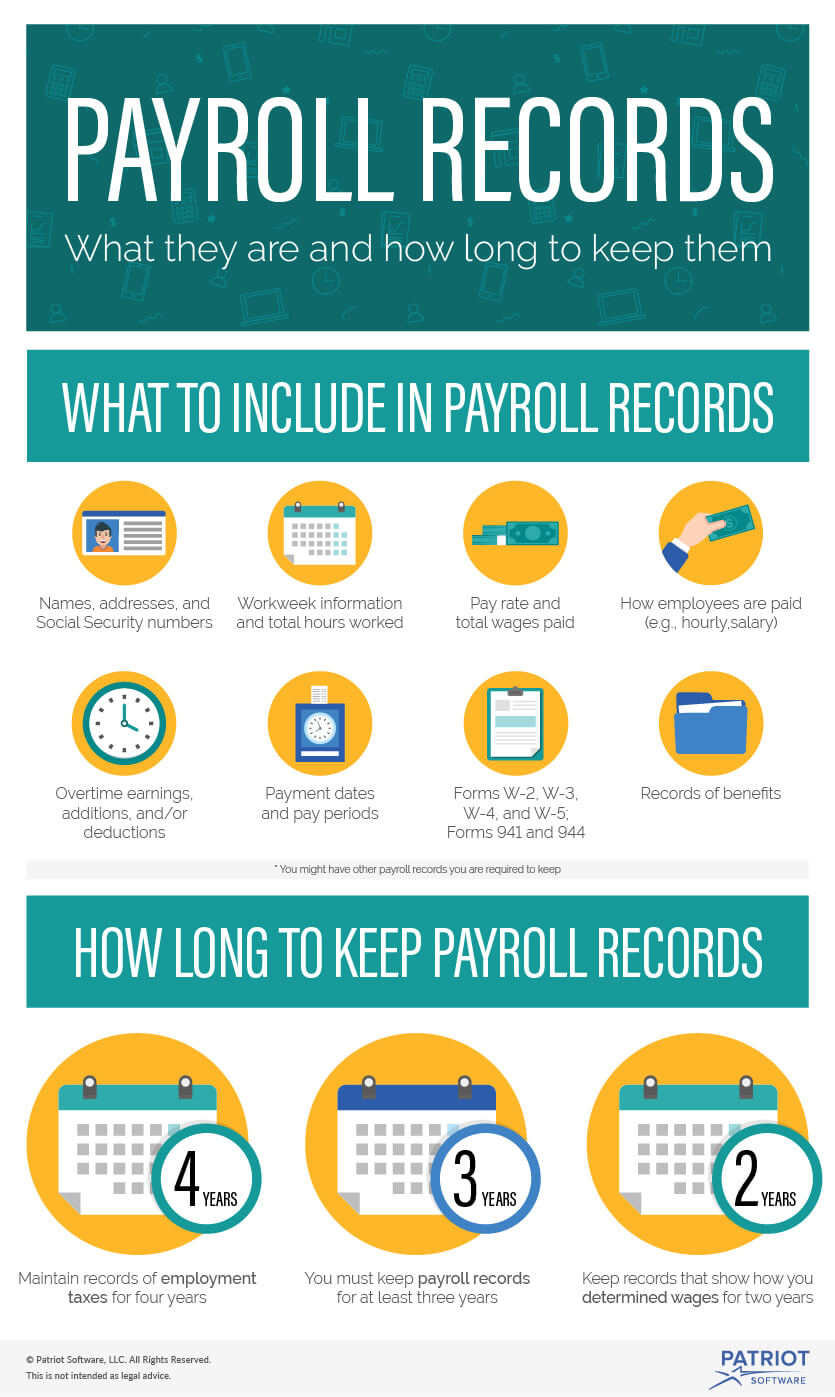

from www.patriotsoftware.com

Web according to the internal revenue service (irs), an employer must retain payroll records relating to payroll taxes a minimum of four years. If you’re an employer, you need to keep a register of employees. Web as a rule of thumb, employers are required to retain some payroll records for at least four years, but some experts. Companies with dec financial year end. Web your company must retain its records for at least 5 years from the relevant ya. Web what employee records do i need to keep? Web the records must be retained for at least 5 years from the end of the financial year in which the relevant transactions. Web for the purposes of section 95(1) of the act, the record retention period for an employee record relating to an.

How Long to Keep Payroll Records Retention Requirements

Record Retention Requirements For Payroll Companies with dec financial year end. Web what employee records do i need to keep? Web your company must retain its records for at least 5 years from the relevant ya. Companies with dec financial year end. Web according to the internal revenue service (irs), an employer must retain payroll records relating to payroll taxes a minimum of four years. Web the records must be retained for at least 5 years from the end of the financial year in which the relevant transactions. Web as a rule of thumb, employers are required to retain some payroll records for at least four years, but some experts. If you’re an employer, you need to keep a register of employees. Web for the purposes of section 95(1) of the act, the record retention period for an employee record relating to an.

From gtm.com

3 Best Practices for Retaining Tax and Payroll Records Record Retention Requirements For Payroll Companies with dec financial year end. Web as a rule of thumb, employers are required to retain some payroll records for at least four years, but some experts. Web the records must be retained for at least 5 years from the end of the financial year in which the relevant transactions. Web what employee records do i need to keep?. Record Retention Requirements For Payroll.

From www.smartsheet.com

How to Create a Data Retention Policy Smartsheet Record Retention Requirements For Payroll Web for the purposes of section 95(1) of the act, the record retention period for an employee record relating to an. If you’re an employer, you need to keep a register of employees. Web according to the internal revenue service (irs), an employer must retain payroll records relating to payroll taxes a minimum of four years. Web your company must. Record Retention Requirements For Payroll.

From www.tradepub.com

Record Retention Schedule Guidelines For Every Office Document Free Guide Record Retention Requirements For Payroll Web the records must be retained for at least 5 years from the end of the financial year in which the relevant transactions. Web for the purposes of section 95(1) of the act, the record retention period for an employee record relating to an. Web as a rule of thumb, employers are required to retain some payroll records for at. Record Retention Requirements For Payroll.

From www.pinterest.com

Employee Record Templates 32 Free Word Pdf Documents Record Retention Requirements For Payroll Web as a rule of thumb, employers are required to retain some payroll records for at least four years, but some experts. Companies with dec financial year end. If you’re an employer, you need to keep a register of employees. Web your company must retain its records for at least 5 years from the relevant ya. Web according to the. Record Retention Requirements For Payroll.

From www.hrledger.com

Payroll Record Retention for Small Business HR Ledger, Inc. Record Retention Requirements For Payroll Web what employee records do i need to keep? Companies with dec financial year end. Web according to the internal revenue service (irs), an employer must retain payroll records relating to payroll taxes a minimum of four years. Web your company must retain its records for at least 5 years from the relevant ya. Web the records must be retained. Record Retention Requirements For Payroll.

From www.hawkinsash.cpa

Record Retention Schedule Hawkins Ash CPAs Record Retention Requirements For Payroll Web what employee records do i need to keep? If you’re an employer, you need to keep a register of employees. Web your company must retain its records for at least 5 years from the relevant ya. Web as a rule of thumb, employers are required to retain some payroll records for at least four years, but some experts. Companies. Record Retention Requirements For Payroll.

From www.sampletemplates.com

13+ Document Retention Policy Samples Sample Templates Record Retention Requirements For Payroll Companies with dec financial year end. Web for the purposes of section 95(1) of the act, the record retention period for an employee record relating to an. If you’re an employer, you need to keep a register of employees. Web the records must be retained for at least 5 years from the end of the financial year in which the. Record Retention Requirements For Payroll.

From studylib.net

records retention and disposition guidelines Record Retention Requirements For Payroll Web your company must retain its records for at least 5 years from the relevant ya. Web for the purposes of section 95(1) of the act, the record retention period for an employee record relating to an. Web according to the internal revenue service (irs), an employer must retain payroll records relating to payroll taxes a minimum of four years.. Record Retention Requirements For Payroll.

From quickbooks.intuit.com

What are payroll records? Definition and Examples QuickBooks Record Retention Requirements For Payroll Companies with dec financial year end. Web as a rule of thumb, employers are required to retain some payroll records for at least four years, but some experts. If you’re an employer, you need to keep a register of employees. Web according to the internal revenue service (irs), an employer must retain payroll records relating to payroll taxes a minimum. Record Retention Requirements For Payroll.

From consentia.com

What is Records Retention? Consentia Record Retention Requirements For Payroll Companies with dec financial year end. If you’re an employer, you need to keep a register of employees. Web as a rule of thumb, employers are required to retain some payroll records for at least four years, but some experts. Web according to the internal revenue service (irs), an employer must retain payroll records relating to payroll taxes a minimum. Record Retention Requirements For Payroll.

From fuseanalytics.com

HR and Payroll Data Retention & Archiving Compliance Fuse Analytics Record Retention Requirements For Payroll Companies with dec financial year end. Web what employee records do i need to keep? Web according to the internal revenue service (irs), an employer must retain payroll records relating to payroll taxes a minimum of four years. Web the records must be retained for at least 5 years from the end of the financial year in which the relevant. Record Retention Requirements For Payroll.

From www.patriotsoftware.com

How Long to Keep Payroll Records Retention Requirements Record Retention Requirements For Payroll Web as a rule of thumb, employers are required to retain some payroll records for at least four years, but some experts. Web the records must be retained for at least 5 years from the end of the financial year in which the relevant transactions. Web for the purposes of section 95(1) of the act, the record retention period for. Record Retention Requirements For Payroll.

From gneil.com

Employee Record Retention Chart Downloadable Record Retention Requirements For Payroll Web the records must be retained for at least 5 years from the end of the financial year in which the relevant transactions. If you’re an employer, you need to keep a register of employees. Web your company must retain its records for at least 5 years from the relevant ya. Companies with dec financial year end. Web what employee. Record Retention Requirements For Payroll.

From www.restaurantowner.com

Record Retention Guidelines RestaurantOwner Record Retention Requirements For Payroll Web according to the internal revenue service (irs), an employer must retain payroll records relating to payroll taxes a minimum of four years. Web what employee records do i need to keep? Web for the purposes of section 95(1) of the act, the record retention period for an employee record relating to an. Web your company must retain its records. Record Retention Requirements For Payroll.

From quickbooks.intuit.com

What are payroll records? Definition and Examples QuickBooks Record Retention Requirements For Payroll Web the records must be retained for at least 5 years from the end of the financial year in which the relevant transactions. Companies with dec financial year end. Web what employee records do i need to keep? Web according to the internal revenue service (irs), an employer must retain payroll records relating to payroll taxes a minimum of four. Record Retention Requirements For Payroll.

From www.kindredcpa.com

Records Retention Guidelines for Individuals Kindred CPA Record Retention Requirements For Payroll If you’re an employer, you need to keep a register of employees. Web as a rule of thumb, employers are required to retain some payroll records for at least four years, but some experts. Companies with dec financial year end. Web according to the internal revenue service (irs), an employer must retain payroll records relating to payroll taxes a minimum. Record Retention Requirements For Payroll.

From www.hrdirect.com

Employee Record Retention Chart 8.5x11 HRdirect Record Retention Requirements For Payroll Companies with dec financial year end. Web your company must retain its records for at least 5 years from the relevant ya. Web for the purposes of section 95(1) of the act, the record retention period for an employee record relating to an. Web the records must be retained for at least 5 years from the end of the financial. Record Retention Requirements For Payroll.

From www.patriotsoftware.com

How Long to Keep Payroll Records Retention Requirements Record Retention Requirements For Payroll Web the records must be retained for at least 5 years from the end of the financial year in which the relevant transactions. Web according to the internal revenue service (irs), an employer must retain payroll records relating to payroll taxes a minimum of four years. If you’re an employer, you need to keep a register of employees. Web what. Record Retention Requirements For Payroll.